VAT compliance has become more of a matter of professionalism in today’s ever-changing business environment, but legal obligations too. As a business owner in Bangladesh, a VAT registration certificate is mandatory in order to run your business legally, gain trust from your partners & avoid penalties from NBR.

This is a step-by-step guide that will walk you through the full process of VAT registration in Bangladesh. Let’s see how Legal Advice BD can help you ease it, whether you have started a new business, run an SME, or scale up your operation.

What Is a VAT Registration Certificate?

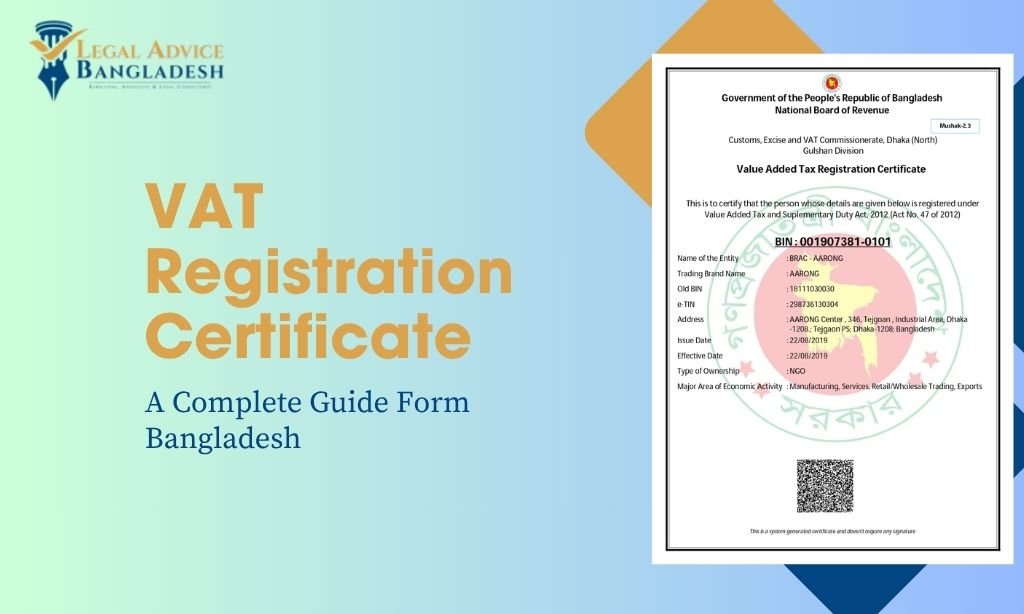

A VAT registration certificate is a legal document certified by the NBR (National Board of Revenue) that proves a business is registered to collect and pay VAT. Upon getting it, your business is assigned a number called the Business Identification Number (BIN). It has to be listed on all VAT-related documents, like invoices, tax returns, and reports.

Who Needs to Register for VAT in Bangladesh?

Any business is required to be registered under VAT in Bangladesh if it meets any of the following conditions:

- Turnover of BDT 3 crore per year or above

- Engaged in the manufacture, wholesale, or supply of taxable services

- Engage in the importation or exportation of any good/product/solution/service.

- Handling sectors where VAT deduction is applicable, like telecom, banking, or transport

- Mandatory irrespective of turnover (e.g, online/cross-border businesses)

Obtaining a VAT registration: It is essential to note that even if your annual turnover is lower than this threshold, you can opt for a voluntary registration for the sake of business credibility or for the sake of becoming eligible to try for some tenders.

Documents Required for VAT Registration

Just before the process begins, make sure to have the following documents ready:

- Trade License

- TIN Certificate (Taxpayer Identification Number)

- National ID card of the proprietor/director

- Bank Solvency Certificate or Bank Statement

- Rental Agreement or Ownership Deed of your business premises

- Photos of the Office Space and Signboard

- Memorandum and Articles of Association (for companies)

- TIN and NID of Directors (if applicable)

In some cases, you might also be required to show utility bills and machine or any other production equipment.

Learn More: Top Agreement Mistakes Bangladeshi Startups Make

Step-by-Step Process for VAT Registration

The VAT registration process can also be done online through the VAT e-Registration System of the NBR. In the simplest of terms, here is a breakdown of it:

1. Visit the VAT e-Registration Portal

Go to the official NBR VAT registration website. You’ll need to create an account using your email address, password, and mobile number.

2. Start a New Application

When you are signed in, choose “New VAT Registration Application” and work through your business information.

3. Provide Business Information

You’ll be asked to input:

- Name of the business

- Trade license number

- TIN

- Address of the business

- Type of business activity

- Bank account details

- Estimated annual turnover

4. Upload Documents

You must upload all the required supporting documents in PDF or JPEG format. Ensure they are clear and valid.

5. Submit and Wait for Verification

The NBR is going to authenticate your application post-submission. They might go to your business location or request more details if needed.

6. Receive Your BIN

If all appeared in order, the NBR would issue your Business Identification Number (BIN), consisting of 13 digits, and would email your VAT certificate of registration. It can be downloaded and printed directly from the portal.

How Long Does It Take?

Assuming all documents are in place, VAT registration usually takes between 5 and 10 working days. If there is a backlog at the NBR, or if your submission is incorrect or has omissions, then there will be delays.

Benefits of Having a VAT Registration Certificate

You don´t just stay compliant with the VAT, getting your VAT certificate (High Value Added tax), you gain several key benefits:

- Legal Operations: You can legally charge and collect VAT from your customers

- Participation in Government Tenders: It is mandatory to possess a valid VAT registration for various tenders.

- Business Credibility: Builds credibility among the business sector, clients, vendors, and partners.

- Avoidance of Fines: No threat of prosecution, fines, or tax audits.

- Easier Record-Keeping: VAT registration instills business discipline and an orderly record-keeping system.

- Eligible for VAT Refunds: If you export a commodity or buy raw materials with VAT paid, you could also receive refunds.

Challenges Businesses Face During Registration

Although the online system has made registration easier, many businesses still struggle with:

- Uploading properly formatted documents

- Providing consistent information across trade license, TIN, and bank records

- Errors in the application that lead to rejections

- Lack of clarity about business classification and VAT applicability

- Long wait times or multiple visits by NBR inspectors

That’s why many businesses prefer to work with legal professionals who can guide them through the process smoothly.

Why Choose Legal Advice BD for VAT Registration?

From Bangladeshi startups and SMEs to large corporations, Legal Advice BD is the preferred choice for businesses that seek to get their VAT and tax right.

Here’s why you should consider us:

- End-to-End Service: Right from preparing, submitting, and following up with your application, up to giving the certificate.

- Accurate Documentation: We verify each detail to ensure that all pay slips are compliant with NBR requirements.

- Quick Turnaround: Enhanced processing with professionals managing forms and communication.

- Affordable Pricing: Clear, cost-effective service packages available for every business.

- Consulting & Advisory: Seek professional advice on whether VAT falls under your business and ensure compliance.

- After-Support: We assist with amendments, updates, and renewals as your company expands.

Post-Registration Responsibilities

When your VAT registration certificate is issued, you have to:

- Keep records of wastage on VAT

- Prepare VAT invoices in the format that you are approved for

- Submit monthly VAT returns (Mushak-9) 1) by the 15th of each month

- VAT collected from customers should be paid timely.

- You should prominently display your VAT registration certificate and BIN in your place of business.

If you do not do so, you risk, for example, penalties, audits, or even the cancellation of your registration.

Final Thoughts

Getting a VAT registration certificate is an important legal obligation for all types of businesses in Bangladesh. It’s bureaucratic, but if everything is done correctly, it’s quite a procedure.

Take the worry out of the process and avoid making costly mistakes with delays in your VAT registration by allowing Legal Advice BD to manage it for you, so you can concentrate on building your business. We have a seasoned legal team that will help support you in staying compliant and prepare you for the future.

Is your business VAT-ready for registration? Reach out to Legal Advice BD now and begin your journey towards legal and financial empowerment.