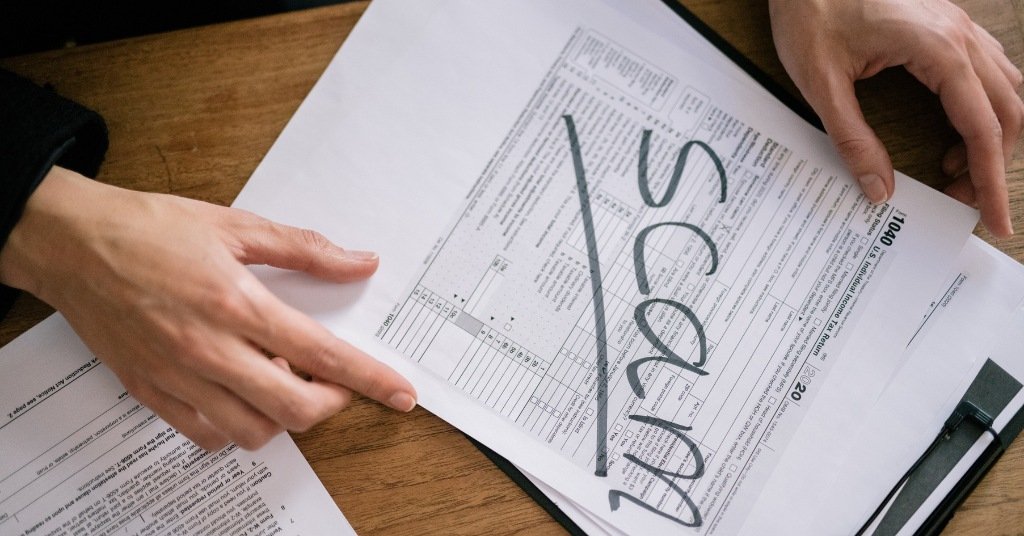

Any business can be a victim of fraud and financial scams. It is an ever-present menace that can bring harm to your monetary interests and reputation. Fraudsters employ intelligent and continually evolving strategies. The most effective defense is to be proactive. You must have a clear strategy to defend your company.

Legal Advice BD is here with a complete guide on how to protect your business from fraud and financial scams! Keep reading!

Common Types of Business Fraud and Financial Scams in Bangladesh

There are a number of financial scams that businesses in Bangladesh have encountered. The first thing is to know them. Let’s start!

Fake Invoice Scams

You may get bills for ads or services you did not use. The invoice looks official. It forces you to pay fast. Most companies make payments without screening. Never make any unconfirmed expenses with your team.

Phishing Email Scams

Through emails, fraudsters impersonate your bank. They cause panic regarding your account. The email has a counterfeit login link. By clicking on it , you steal your banking information. Do not open links in unanticipated emails.

Advance Fee Fraud

Fraudsters guarantee big contracts or loans. They require initial processing fees. After you pay, they disappear. Legitimate firms would hardly request fees in that manner.

Supplier Fraud

Poor products are offered by counterfeit suppliers. Others receive the money and fail to deliver. Some are playing as your ordinary dealer. They send modified payment information. Check the changes in the bank accounts always by calling the bank.

Cheque Fraud

Fraudsters use counterfeit cheques as overstock. They want you to give a refund of the difference. Later, their cheque bounces. You lose the refund amount. Check cheque payments by new partners.

How to Protect Your Business from Fraud and Financial Scams in Bangladesh: Explained

Fraudsters are becoming more intelligent. Defending your business means basic daily discipline. These are some major measures you can take.

Train Your Staff

Your employees are your front-line defense. Educate them on standard frauds. Demonstrate to them how to identify fake invoices and emails. They should also be encouraged to inquire in case something appears suspicious. A professional team is capable of halting fraud before it occurs.

Control Access to Money

Not all employees require access to bank accounts. Restrict the approving authority of payments. Apply the two-person rule on large transactions. This implies that two individuals should be making the approval on a payment prior to the transmission of such. This is a simple measure that helps an individual not to commit an expensive mistake.

Verify Everything

Check payment requests twice. In case a supplier transmits new bank details, call him/her on a known number to verify. Do not include the phone number as part of the email. You must ensure that you have taken delivery of goods or services before paying an invoice.

Use Strong Digital Security

Use effective passwords for your business accounts. Do not leave the same password everywhere. Activate two-factor authentication in email and bank accounts. This provides an added security. It prevents thieves even in case they steal your password.

Look at Your Finances Frequently

Examine your bank accounts each week. Search through any minor and unusual payments that you do not know. Fraudsters will also first spend a small sum to verify your account. The frequent reviews can assist you in identifying issues beforehand.

Create a Clear Policy

Prepare a basic anti-fraud policy for your business. It must describe the procedures for approving payments and reporting suspicious activity. Your business would be much safer if all people were guided by the same rules.

Strengthening Internal Financial Controls

To protect your business from external threats, you need to make your internal financial control strong. Go through these tips and tricks!

- Separate Key Duties: Cash, record keeping, and approving payment should be done by different staff.

- Mandatory Dual Authorization: Two managers have to authorize large or unusual payments.

- Periodical Reconciliation: Compare bank performances with in-house records monthly.

- Keep Numbered Documents: Keep a trail of all invoices and receipts using pre-numbered copies so that they are not lost.

- Restrict Access to Financial Software: Only employees who require financial software access should be given access.

- Schedule Surprise Audits: Make unplanned checks to guarantee compliance and discourage fraud.

- Safe Asset: Store cash, cheques, and valuable papers in a safe that is locked up.

Employee Awareness and Training to Prevent Fraud

Your employees are your strongest shield against fraud. Educate them on the existence of some common scams, such as phishing emails and counterfeit invoices.

Train them to make phone checks on payment requests prior to sending money. Justify why two-factor authentication and strong passwords are essential. Promote a culture in which employees are not afraid of reporting suspicious behavior. Simple training sessions that are frequently held serve as reminders.

A knowledgeable staff is a human firewall that shields your business against expensive financial fraud. This continuous training is a minor cost that results in huge losses.

To understand the legal process better, read our guide on how to file a case in Bangladesh for step-by-step instructions and helpful legal insights.

Legal Safeguards for Businesses in Bangladesh

- Registration of the business: Register your business at the RJSC. This establishes a legal identity and is the prerequisite of all other protections.

- Well-written Contracts: Every business transaction should use properly documented contracts. Establish payment conditions, delivery times, and fines for violations. This helps to avoid disputes in the future.

- Intellectual Property Protection: Register your trademarks and patents. This prevents imitations of your brand name, logo, or products by others.

- Compliance with the Digital Security Act: Keep knowledge of the Digital Security Act. Do not get into legal problems and follow the rules of online transactions and data protection.

- Adequate Labor Contracts: Issue official appointment letters and employment agreements. This gives clear rights and duties of the employer and the employee.

- Legal Relationships with Partners: Prepare a comprehensive partnership deed or shareholder agreement. This safeguards all investments as well as defining the mode of resolving conflicts.

Learn effective strategies to maintain transparency and integrity by reading our guide on how to protect your company from corruption in Bangladesh.

Conclusion

Fraud prevention requires continuous effort. Be vigilant and train your staff. Always check requests for money. Use strong passwords and two-factor authentication. And follow your gut. When an offer appears to be too good to be true, it probably requires inspection. These are basic habits that build a powerful shield. They save your business and secure it in the future. Start to incorporate them from today.

Hopefully, you understood how to protect your business from fraud and financial scams! If you need further help, feel free to reach out Legal Advice BD!